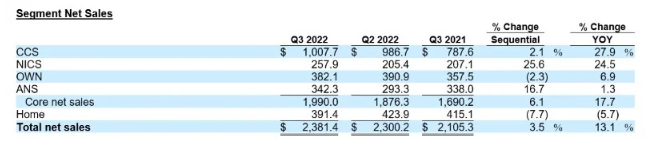

CommScope revealed that their core net sales in the third quarter of 2022 increased by 17.7% year-over-year to $1.99 billion, primarily due to higher net sales in the Connectivity and Cable Solutions (CCS), Networking, Intelligent Cellular and Security Solutions (NICS) and Outdoor Wireless Networks (OWN) segments.

“I am pleased to share that we delivered Core net sales of $1.99 billion and Core adjusted EBITDA of $353 million for the third quarter of 2022 – our highest performance on record since completing the ARRIS acquisition. As we have continued to reiterate over the last several quarters, we are taking swift action to drive growth in our business and offset inflationary impacts. Our third-quarter results, namely turning our NICS segment profitable in the quarter, are a testament to our execution. While supply chain challenges remain and there is broader macroeconomic uncertainty, we maintain our expectation to deliver Core adjusted EBITDA for the full year 2022 within the previously provided range of $1.15–$1.25 billion,” said Chuck Treadway, President and Chief Executive Officer.

Net income of $22.9 million, or $0.04 per share, in the third quarter of 2022, also improved compared to the prior-year period's net loss of $124.2 million, or $0.68 per share.

CommScope Q3 2022 Figures

Treadway added, “Our CommScope NEXT transformation continues its strong progression in driving organic growth and efficiency opportunities throughout the Core company. Our teams have executed well in ramping capacity, and our general manager model is enabling greater visibility and flexibility in how we manage our business. As we drive all of these initiatives forward, we believe CommScope is well-positioned to deliver on our targets and create significant incremental shareholder value.”

Breaking down the segments, CCS amounted to net sales of $1.008 billion, an increase of 27.9% from the prior-year period, driven by growth in Network Cable and Connectivity.

Moreover, NICS garnered net sales of $257.9 million, surging by 24.5% from the prior-year period, driven by growth in Ruckus Networks.

The OWN segment’s net sales reached $382.1 million, an increase of 6.9% from the prior-year period, driven by growth in Integrated Solutions and HELIAX products.

On the other hand, Access Network Solutions’ (ANS) net sales of $342.3 million increased by 1.3% from the prior-year period, driven by growth in Access Technologies.

Separately, home net sales were at $391.4 million, a decrease of 5.7% from the prior-year period, due to the decline in Broadband Home Solutions.