The unexpected shortage in semiconductor microchips has witnessed increasing cases of stunted or late car production and deliveries, a shortfall in home appliances, and costlier smartphones across the globe.

Competition of other use cases of the chips against the demands of the expansive consumer electronics industry has been quite rough in recent months.

Several causes resulted in the chip scarcity – the demands from the consumer electronics industry during the pandemic as people worked from home and engaged in gaming and streaming activities and the US sanctions against Chinese technology companies added to the semiconductor shortage woes. Additionally, Taiwan, the world’s biggest supplier of computer chips, mostly made by the Taiwan Semiconductor Manufacturing Company (TSMC) had to endure the brunt of major drought conditions. Since the production of chips requires heavy use of water, the reservoirs dried up and thereby disrupted the production process.

Consequently, the surge in demand has thrown major challenges to the supply aspect of the chips. According to the Semiconductor Industry Association (SIA), chip sales in January 2021 hit $40 billion, which is up 13.2 percent on the same month last year.

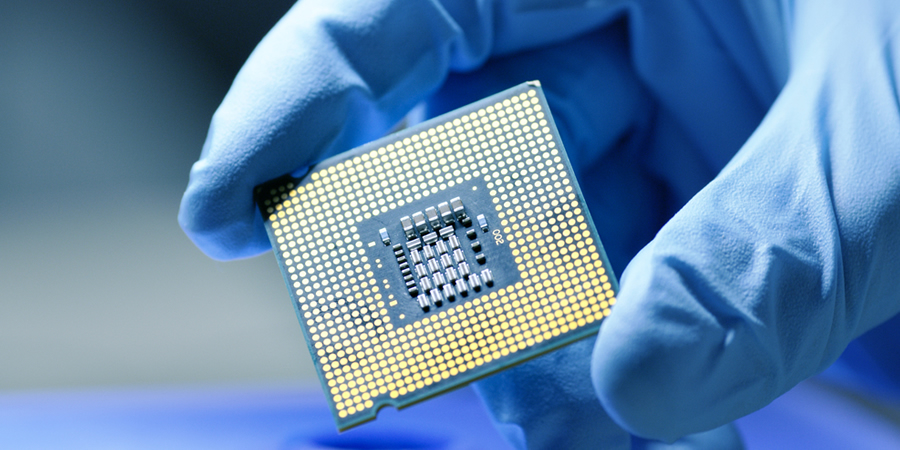

The recent ongoings in the semiconductor market have triggered a re-think on the reliance on foreign-built chips since they are a key component in cars, smartphones, home appliances, and other electronic equipment for use in sensors to control units. Processors and semiconductor technologies are key to connected devices and data processing.

Owing to the shortage, the Chinese government has adopted the policy to boost the domestic semiconductor sector as demand for chips grows. This trend has become a global one, with major US companies including Google, Amazon, and Facebook investing in their chip-making efforts. Chinese internet giants, automakers, and even home appliance firms are investing heavily in semiconductor research and development.

In the US, the semiconductor industry is requesting president Joe Biden's administration and Congress to fund semiconductor incentives included in last year’s National Defense Authorization Act.

Chip shortages have cost the global auto industry 130,000 vehicles in lost production, research firm AutoForecast Solutions estimates, with the heaviest impact in North America, with 74,000 units lost, and Western Europe, with 35,000 lost.

The scarcity of chips initially hit the auto industry, however, it has now come to affect all types of chips ranging from hardware products, including smartphones. This has led the Chinese smartphone maker Xiaomi Corp president Wang Xiang to say that the global chip shortage was adding to the company's production costs and the higher prices of its products might affect the consumers. Qualcomm Inc, a key supplier to Xiaomi, is struggling to meet orders for major smartphone brands.

What is hindering chip production?

Typical semiconductor factories have limited capacity and building new factories takes massive investment and often several years. They have to be built in factories with ultra-controlled environments, called ‘fabs.’ Dust particles, temperature fluctuations and even static electricity can damage the complex workings of semiconductors. According to analysts, currently, fabs are running at full capacity and will take months or years before new ones come online to fill the extra demand.

Shortage in chip production highlights demand for ICT devices

The higher profit margins from the production of smartphone and tablet chips are much more alluring to chip-makers than from older technology used in cars. As a result, Taiwan's tech firms saw revenue growth from demand for chips for laptops, tablets, smartphones, and other products to support the work and study at home around the world during the COVID-19 pandemic.

TSMC has announced plans to spend $28 billion on increasing chip production capacity in 2021. Last year, the Chinese government invested $22 billion into domestic chip production and it is likely to double the budget in 2021. Likewise, the US government seems to have realized the importance of the semiconductor industry to national security and a thriving economy as almost all IC chips used in the US are made abroad.

The shortage in chip production can be attributed to the unprecedented demand in tech devices and services for organization and individuals alike. In such a scenario, the role of ICT sector in providing integrated network and connectivity solutions is only going to grow. Additionally, the adoption of 5G technology and migration to the cloud will accelerate the use cases for hyper-connected rooms and other multi-dwelling units (MDU) owners and operators to deliver multiple 4K video streams, IPTV, virtual reality, VoIP, and ultra-fast downloads.

A recent report by Gartner forecasts that the highest growth in IT spending will come from the device segment (14 percent) followed by the enterprise software (10.8%) as organisations transition into a digitalized work environment.

By taking a hint from the current state of the semiconductor demand and supply, ICT stakeholders would do well to facilitate knowledge discussion, brainstorm innovative ideas through proofs-of-concept and pilot projects and prepare the tools and know-how to build and scale sustainable business models.

Given the current scenario of economic recoveries after the pandemic, organizations and businesses will require a mix of remote and hybrid employee arrangements in smarter offices, warehouses, and factories with continued demand for flexible digital infrastructure — networks and applications that can serve workers regardless of where they may be located. More than 80% of company leaders plan to have employees continue working remotely, with almost half planning to have some employees work remotely full time.

Enabling organizations to implement a unified network infrastructure that supports both end-user and operational needs are areas that warrant the consideration of ICT players in all categories.