By Tom Loozen, EY global telecommunications leader

5G is key to industrial transformation, but 5G providers must boost levels of ambition and confidence among their enterprise customers.

In brief

- The 5G investment outlook remains strong in 2022 among enterprises across industry verticals.

- However, only a quarter of enterprises are very confident in their ability to successfully implement 5G.

- As sustainability continues to top the corporate agenda, 5G providers must ensure that 5G and IoT use cases better address sustainability needs.

Despite healthy levels of current and future spending on a range of emerging technologies and interest in use cases that can deliver resilience during the pandemic, the world of industrial 5G faces some significant challenges. The degree to which enterprises are convinced about the 5G opportunity is in question as the latest EY Reimagining Industry Futures study (pdf) reveals only 24% of respondents are truly confident that their organization can successfully implement 5G.

It’s therefore more important than ever that 5G providers step up to help enterprises address their critical pain points, solidify ecosystem partnerships, drive positive financial outcomes and implement 5G and related technologies with confidence.

To do this, it is vital to understand what enterprises really think about 5G, so that service providers can truly position themselves as trusted business partners. The latest EY Reimagining Industry Futures study (pdf) reveals six invaluable insights that all vendors should consider.

- Spending Intentions Are Strong but 5G Adoption Is Not Guaranteed

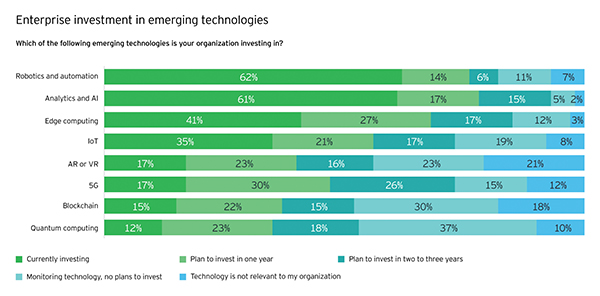

The outlook is bright for enterprises’ adoption of emerging technologies over the next three years. Our research finds that current and planned investments are rising in five out of eight emerging technology categories, with only automation and blockchain showing year-on-year decline.

Future spending intentions are highest in 5G, with its role in responding to environmental, societal and governance (ESG) risks top of mind. Organizations are more interested than before in 5G use cases that can help them meet sustainability goals (68%) and improve supply chain management (65%).

Yet, long-term adoption of 5G is not guaranteed, and vendors should not be complacent. The number of Asian companies planning to invest in 5G is down nearly 10% from last year. Technology providers should recognize that, even as 5G becomes more mainstream, some organizations may become less receptive to it.

- Enterprises’ 5G Vision Has Become More Defensive

A more defensive mindset toward 5G and IoT has taken hold — one that prizes efficiency and optimization ahead of entering adjacent markets and driving top-line growth. Increasing IoT’s contribution to operational efficiency is enterprises’ top IoT priority, cited by a greater proportion of respondents compared with last year.

Mirroring these findings, fewer enterprises compared with last year regard new products and service creation as a rationale for spending on IoT, and sophisticated 5G use cases featuring virtual reality (VR) or augmented reality (AR) are rated as a key application by only 28% of respondents.

Meanwhile, the same ESG considerations that are fueling greater interest in 5G are also translating into new demands on technology providers, who are under pressure to respond. Among respondents, 47% of businesses don’t think the use cases offered by vendors adequately address their sustainability needs.

5G providers should take these attitudes on board and provide a more compelling vision of 5G’s potential to drive top-line growth while ensuring that their use cases meet organizations’ near-term needs.

- Enterprises Are Receptive to New Ways of Purchasing and Deploying 5G

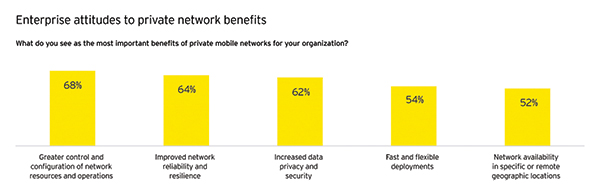

Enterprises are receptive to 5G solutions that are delivered through disruptive business models. The study revealed that 77% of businesses are interested in using private networks to support the implementation of 5G and IoT use cases. In addition, 50% of respondents rate the purchase of private network capabilities as an important 5G investment strategy for their business, citing a range of benefits led by greater network control (68%) and improved network reliability (64%).

At the same time, 71% of businesses would consider purchasing 5G through an intermediary such as a mobile virtual network operator (MVNO), and 64% say that directly acquiring 5G spectrum could be important for them.

Taken together, these disruptive customer signals suggest that telcos’ traditional relationships with enterprise customers are under pressure — and that more agile go-to-market strategies are essential in the world of 5G-powered IoT.

- 5G’s Relationship to Other Technologies Is in Focus but Cyber Risks Receive Less Attention

Businesses cite poor understanding of 5G’s relationship to other emerging technologies as their number one internal challenge, up from fifth last year. Looking ahead, exploring 5G’s relationship to other technologies is also their top priority. This underlines their desire to exploit a mutually beneficial combination of “frontier” technologies and implies that organizations would benefit from ongoing education around the basics of emerging technologies.

Interestingly, only 22% of organizations view mitigating cyber threats as a priority within their IoT agenda — ranking lowest — and mitigating cyber risks ranks only sixth as a 5G priority. Given the range of potential attack surfaces present in Industry 4.0, enterprises should ensure that “security by design” principles underpin their 5G and IoT deployments, as this could become a dangerous blind spot if this trend continues.

- Network Vendors Are Gaining Trust as Transformation Experts While Telcos Are Lagging

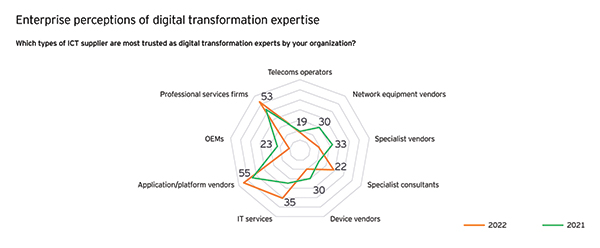

As enterprises look to their technology and telecoms providers to support their 5G journeys, our findings cast an interesting light on the selection criteria they apply. Competitive pricing dominates as the top attribute currently sought by enterprises in vendors, overtaking speed of execution. And looking to the future, enterprises rate suppliers’ ability to co-create and customize solutions as the two most desirable attributes.

The importance of collaboration underlines how enterprises are looking for transformation partners, not just technology suppliers. However, enterprises’ opinions are divided on which suppliers have digital transformation expertise. Application and platform vendors lead with 55%, narrowly ahead of professional services firms (53%), while network equipment vendors (30%) are gaining ground year-on-year.

Telcos lag behind as only 19% of enterprises regard them as digital transformation experts. Although they top score as IoT experts (54%), they are much less trusted to deliver transformation through new forms of connectivity. Improving their credibility as enablers of positive business outcomes is essential.

- Enterprises’ Ecosystem Strategies Are Becoming More Ambitious

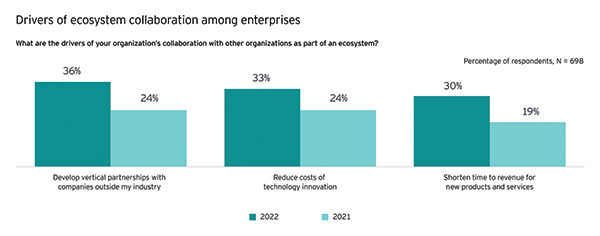

Ecosystem collaboration stands out as an essential route toward new skills and knowledge among enterprises as they look to take advantage of new technologies. 69% already collaborate with other organizations within business ecosystems, and even more (75%) believe ecosystem strategies will be central to their five-year growth outlook.

Crucially, the drivers of ecosystem strategies are becoming more ambitious, with a growing emphasis on rationales such as developing cross-sector partnerships and shortening time to revenue for new products and services.

Critically, 73% of respondents say they’ll prioritize suppliers that can offer relevant ecosystem relationships as part of their 5G capabilities. As a result, 5G providers must be able to tap into fast-changing corporate ecosystems if they are to meet their customers’ evolving expectations.

Summary

5G remains highly relevant to organizations, particularly as they look to build greater resilience in the wake of the pandemic. Yet, businesses may be overlooking opportunities for growth, and they need more support from their suppliers if they are to make the most of Industry 4.0.